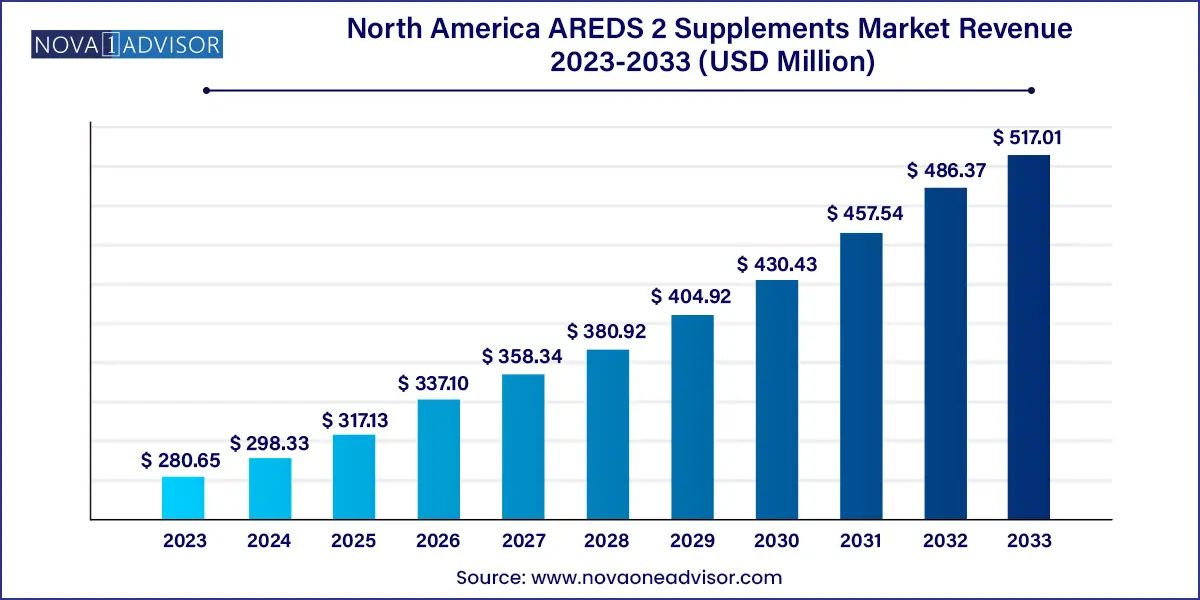

The North America AREDS 2 supplements market size was exhibited at USD 280.65 million in 2023 and is projected to hit around USD 517.01 million by 2033, growing at a CAGR of 6.3% during the forecast period 2024 to 2033.

The North America AREDS 2 supplements market is a highly specialized yet steadily expanding segment within the broader nutraceutical and eye health product industry. AREDS 2 supplements are dietary formulations based on the Age-Related Eye Disease Study 2 (AREDS2), a clinical trial sponsored by the National Eye Institute (NEI), which demonstrated that specific nutrients could reduce the risk of progression in age-related macular degeneration (AMD)—a leading cause of vision loss in older adults.

These formulations typically contain a standardized combination of vitamins C and E, zinc, copper, lutein, and zeaxanthin. They are primarily recommended for individuals in the intermediate or advanced stages of AMD, particularly those over the age of 50. As the aging population across North America grows rapidly, so does the demand for vision-preserving solutions, thereby driving the adoption of AREDS 2 supplements.

The U.S., with its well-established pharmaceutical infrastructure and proactive aging population, is the dominant market, followed by Canada and Mexico. The surge in eye health awareness, expanding access to ophthalmologic care, and the increasing popularity of preventative healthcare are fueling this market's growth. Furthermore, the crossover between the nutraceutical and pharmaceutical sectors—coupled with aggressive D2C (direct-to-consumer) marketing strategies—is pushing AREDS 2 supplements into mainstream health discussions.

Unlike generalized vitamins, AREDS 2 supplements occupy a niche built on robust clinical backing. Their ability to deliver scientifically validated outcomes makes them a unique proposition in an often-unregulated supplement industry. Moreover, eye care professionals across North America continue to endorse these products, strengthening their credibility and encouraging their long-term use among at-risk populations.

Increased Awareness Around Age-Related Eye Diseases: Public campaigns and rising incidence of macular degeneration have led to a more informed patient population seeking AREDS 2 solutions.

D2C Supplement Brands Expanding Reach: Emerging companies are using subscription models, online consultation tools, and social media marketing to reach older consumers directly.

Gummy and Chewable Formulations Gaining Ground: Innovations in dosage forms, including palatable options for patients with difficulty swallowing pills, are expanding consumer preference.

Ophthalmologist Endorsement Driving Credibility: Endorsements by eye care professionals remain a strong influencer in consumer decision-making, particularly in older demographics.

Retail Pharmacy Expansion: Pharmacies are promoting eye health supplements with in-store educational signage and loyalty discounts, making them more accessible to walk-in consumers.

Bundling With General Health Supplements: AREDS 2 formulations are increasingly bundled with multivitamins or brain health products to create holistic aging-support packages.

Private Label Growth in Pharmacies: Retail pharmacy chains are launching in-house brands of AREDS 2 supplements, offering competitive pricing and branding to challenge legacy players.

Sustainability Focus in Packaging: Some companies are switching to eco-friendly bottles and refill subscription models, aligning with broader sustainability goals among consumers.

| Report Coverage | Details |

| Market Size in 2024 | USD 298.33 Million |

| Market Size by 2033 | USD 517.01 Million |

| Growth Rate From 2024 to 2033 | CAGR of 6.3% |

| Base Year | 2023 |

| Forecast Period | 2024-2033 |

| Segments Covered | Product, Distribution Channel, and Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Country scope | U.S., Canada, Mexico |

| Key Companies Profiled | Bausch + Lomb, Alcon Inc.; Nature Made (Pharmavite LLC); Viteyes (Vitamin Health, Inc.); EyePromise (ZeaVision, LLC); MacuHealth; NATURELO Premium Supplements, LLC; VISTA; Codeage LLC; NutraChamps Inc. |

The primary driver of the North America AREDS 2 supplements market is the rapid rise in the aging population, particularly among the 55+ demographic, which is most susceptible to age-related macular degeneration (AMD). According to the CDC and NEI, AMD affects approximately 11 million people in the U.S. alone, with projections estimating this number will double by 2050. As aging accelerates visual degradation and increases oxidative stress in retinal tissues, the demand for science-backed, preventive eye care interventions is surging.

AREDS 2 supplements offer a clinically validated solution that appeals to both patients and physicians. With more ophthalmologists recommending these formulations as part of a broader AMD management plan, patients are increasingly incorporating them into their daily health routines. The aging population is also more proactive about quality-of-life maintenance, making them receptive to non-invasive, preventative therapies such as nutritional supplementation. This demographic tailwind ensures a strong foundation for market growth in the coming decade.

One key restraint for the market is the relatively low adoption of AREDS 2 supplements among individuals who are in the early or undiagnosed stages of AMD. Many patients do not seek eye care until noticeable vision issues arise, by which time the window for preventative care may be reduced. Moreover, despite the NEI’s strong advocacy, general awareness of the specific AREDS 2 formulation remains limited outside eye care specialist circles.

This lack of awareness is compounded by the fact that many over-the-counter supplements marketed for "eye health" do not adhere to the precise AREDS 2 formula, potentially misleading consumers. Consequently, many patients may be taking suboptimal products or none at all, due to a misunderstanding of their risk profile or product efficacy. Bridging this knowledge gap remains a challenge, especially in non-urban populations and among less tech-savvy older adults.

A major opportunity lies in the integration of AREDS 2 supplement sales with the rapidly growing telehealth ecosystem. As more ophthalmologists offer virtual consultations, particularly in rural or underserved areas, there is a significant opportunity to educate and recommend AREDS 2 supplements via digital channels. This telehealth integration can enable seamless prescription and product delivery—either directly through branded websites or pharmacy partnerships.

Additionally, e-commerce platforms can offer personalized shopping experiences, dosage reminders, auto-refill subscriptions, and bundled products that cater to eye health. These convenience-enhancing strategies are particularly well-suited for aging consumers, who prefer simplified, hassle-free solutions. Brands that capitalize on online education tools, vision health blogs, webinars, and customer support will gain a significant advantage in engaging and converting new users.

Capsules dominated the product category, primarily due to their widespread availability, ease of consumption, and standardization of dosage. Capsules are also preferred for their faster disintegration and absorption rates compared to tablets. Consumers over 50, who typically make up the majority of AREDS 2 supplement users, often report that capsules are easier on the digestive system and have fewer binders and fillers. Most established brands, including PreserVision by Bausch + Lomb, offer their AREDS 2 formulations in capsule format, reinforcing this preference. Additionally, capsules are more often preferred by patients taking multiple daily medications, as they are smaller and easier to swallow.

Soft gels are the fastest-growing segment, fueled by increasing consumer preference for smoother ingestion and enhanced bioavailability. The soft gel format appeals to those who have difficulty swallowing traditional capsules or tablets, including the elderly and those with medical conditions affecting the throat. Furthermore, companies are innovating by infusing soft gels with additional eye-supporting nutrients or flavors to improve palatability. Soft gels also offer superior encapsulation of oil-based compounds like lutein and zeaxanthin, improving the stability and shelf life of these sensitive ingredients. These functional benefits are expanding the soft gel segment rapidly, especially in premium supplement lines.

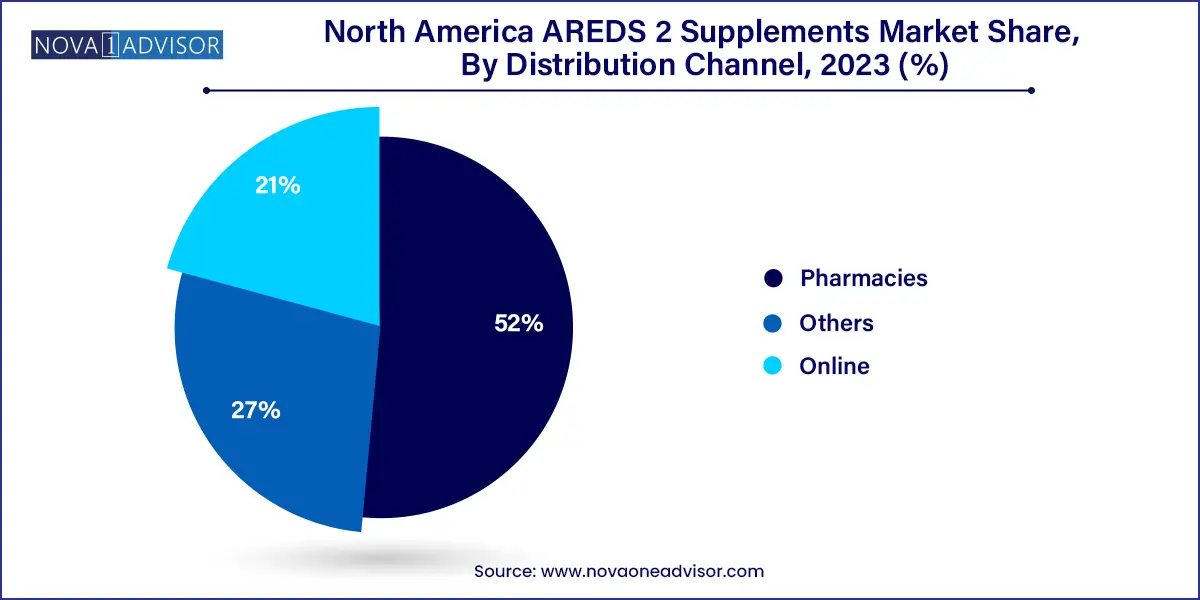

Pharmacies dominated the distribution channel, as these retail points remain the first line of contact for most consumers seeking over-the-counter (OTC) eye health solutions. In-store pharmacists often recommend AREDS 2 supplements to customers filling prescriptions for AMD-related treatments or undergoing routine eye exams. Chain pharmacies like CVS, Walgreens, and Rite Aid have capitalized on this by launching their private-label versions of AREDS 2 supplements, often positioned near vision care products. The trust and credibility of pharmacy professionals significantly influence purchasing behavior, especially among older adults who prefer face-to-face interactions and explanations.

Online sales are the fastest-growing channel, thanks to the expanding e-commerce footprint and the growing comfort of older consumers with digital platforms. Online channels offer greater product variety, competitive pricing, detailed educational resources, and subscription models that automate repeat purchases. Direct-to-consumer supplement brands such as MacuHealth and Focus Vitamins are leveraging digital marketing and educational content to reach targeted demographics. Amazon, Walmart.com, and iHerb also play key roles in online visibility and accessibility. With digital health monitoring becoming mainstream, these platforms are increasingly integrated with reminders, product reviews, and AI-powered recommendations, making them attractive to tech-savvy and convenience-seeking consumers.

The U.S. leads the North America AREDS 2 supplements market with a well-developed healthcare system, robust supplement industry, and strong eye health awareness campaigns. The National Eye Institute and American Academy of Ophthalmology have played pivotal roles in promoting AREDS 2 usage among older adults. The aging population, increasing prevalence of AMD, and high availability of OTC supplements contribute to strong market penetration. Direct-to-consumer telehealth platforms, such as Teladoc and Hims, have also started including vision care and supplement recommendations, expanding outreach. Moreover, U.S. pharmacies and eye clinics often include AREDS 2 supplements in AMD treatment plans, solidifying their role in preventive vision care.

Canada follows the U.S. in AREDS 2 supplement adoption, driven by aging demographics and a growing emphasis on preventive health. While the regulatory environment under Health Canada is more stringent, it ensures consumer trust in product quality and safety. Many Canadian consumers prefer buying supplements through local pharmacies or online portals backed by clinical affiliations. Cross-border purchases from U.S. brands are also popular due to wider variety and competitive pricing. Public health agencies and eye health nonprofits in Canada actively promote AMD screening, indirectly supporting AREDS 2 supplement awareness and usage.

Mexico is an emerging market for AREDS 2 supplements, with increasing awareness of eye health among its aging population. Urban centers like Mexico City and Monterrey are seeing growth in ophthalmologic clinics and eye health campaigns, especially targeting diabetes-related vision issues, which also impact AMD risk. Although supplement uptake is lower than in the U.S. and Canada, the potential for growth is significant. Online pharmacies and private clinics are beginning to offer U.S.-branded AREDS 2 supplements, and local nutraceutical manufacturers are exploring partnerships with international brands to introduce tailored formulations at accessible price points.

January 2025: Bausch + Lomb announced a new version of its PreserVision AREDS 2 Formula, now available in a vegan capsule format to appeal to ethically conscious and allergen-sensitive consumers.

February 2025: MacuHealth launched a soft gel variant with enhanced zeaxanthin concentrations, claiming improved absorption rates and targeted macular pigment support.

March 2025: CVS Health introduced a private-label AREDS 2 supplement under its Gold Emblem line, priced competitively to challenge premium brands while maintaining core AREDS 2 compliance.

January 2025: Focus Vitamins rolled out a new e-commerce subscription model, offering discounts and monthly refills along with eye health content curated by ophthalmologists.

February 2025: Hims & Hers Health Inc. partnered with licensed optometrists to offer virtual AMD screening consultations and bundled AREDS 2 supplement prescriptions via its D2C platform.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America AREDS 2 supplements market

Product

Distribution Channel

Country